As the automotive landscape continues to evolve, A. Anthony’s Mobile Vehicle Service emerges as a frontrunner, offering tailored solutions for private car owners, used car buyers and sellers, as well as small business fleet operators. This innovative service model not only brings quality maintenance and repairs directly to the client’s doorstep but also addresses the growing demand for efficiency and convenience in vehicle care. In the following chapters, we’ll first explore the operational framework that defines A. Anthony’s service offerings, then we’ll delve into the customer experience that sets the business apart. Next, we will discuss how this mobile service impacts the local automotive market, before finally examining future trends in mobile vehicle services that promise to shape the industry.

null

null

Bringing the Repair Bay to You: A Customer-Centered Narrative of A. Anthony’s Mobile Vehicle Service

When a car hiccups in the middle of a busy day, the last thing a driver wants is a schedule that stretches into the following week. A. Anthony’s Mobile Vehicle Service reframes that dilemma by offering something deceptively simple: care delivered where the vehicle sits. The chapter on customer experience traces how this approach transforms a routine maintenance task into a smooth, predictable, and trustworthy encounter. From the moment a client discovers the service online to the receipt and follow up after the technician has left the driveway, the emphasis is on clarity, courtesy, and reliability. This is not merely about fixing a problem; it is about easing the anxiety that can accompany car trouble, especially for people juggling work, family, and a long list of daily commitments. The service model itself—on site, at a home or workplace—reads as a response to a broader shift in consumer expectations: the demand for time value, transparency, and a human touch in a digital age.

Booking a visit begins the experiencescape. The process is designed to minimize friction. An online scheduling option invites clients to choose a specific service package or to request a diagnostic, with clear descriptions of what is included and what is not. The conversation that follows is not a hard sell but a guided path toward the right solution. The pricing structure is presented as fair and upfront, a cornerstone of trust that remains constant throughout the engagement. There are no hidden fees, no surprise add-ons. What customers see at the outset is what they pay at the end, a principle that matters as much in a mobile setting as it does in a brick and mortar shop. The transparency here is more than a policy; it is a philosophy that informs every interaction, from the initial phone call to the final digital receipt.

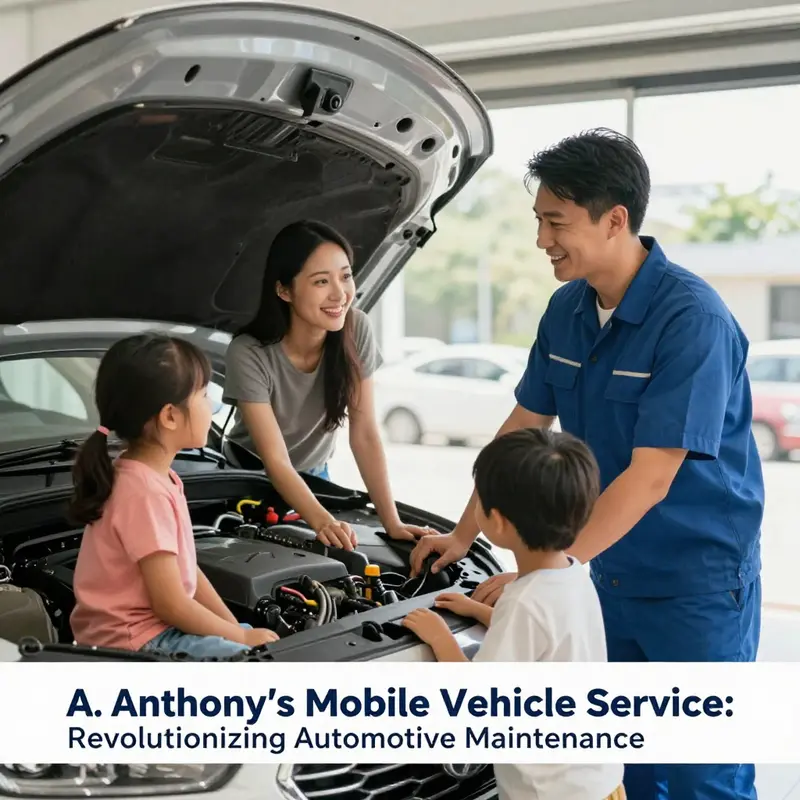

The day of service unfolds with the same spirit of respect that marks every stage of the encounter. The technicians arrive in a clearly identified vehicle, with professional attire and a careful approach to the client’s property. They treat driveways and entryways as if they were a customer’s own workspace, protecting floors, clearing a safe path for tools, and laying down mats when necessary. The equipment is portable yet sophisticated, a nod to the competence required to perform precise diagnostics and repairs on a non-stationary workflow. The technicians carry standardized checklists that ensure critical tasks are not overlooked, while still allowing for adaptive decision making. When a diagnostic needs to be run, the team explains what each step reveals in plain language, inviting questions and multiple perspectives before decisions are made. The goal is not to win an argument about which component is failing; it is to reach a shared understanding of the problem and a plan that the client feels confident will restore both safety and performance.

Communication is the backbone of the experience. It begins with expectations about time: arrival windows that respect the client’s schedule, and updates if delays occur. It continues with updates during the service: what is being inspected, what findings exist, and what those findings mean for the vehicle’s future. This approach echoes the broader industry realization that information is a form of service. A client who understands what is happening is less anxious and more cooperative, which makes the job safer and the outcome more reliable. The technicians are trained to be not only technically proficient but also courteous and patient. They listen as much as they explain, pausing to confirm whether a recommendation aligns with the client’s priorities and budget. Even in moments that could be awkward—like discussing the necessity of a repair in a driveway setting—the tone remains respectful and professional. The result is an encounter that feels collaborative rather than coercive, a subtle but powerful shift that helps turn one-off visits into lasting relationships.

Price and value walk hand in hand in this mobile model. A. Anthony’s emphasizes a pricing structure that clients can trust, with an emphasis on worth rather than speed. The aim is to deliver value through skill, efficiency, and a transparent scope of work. When a client asks whether a particular service is necessary, the technicians respond with practical explanations about short and long-term benefits, including safety, reliability, and the preservation of vehicle value. In many households, the car is a lifeline to work, school, and healthcare. The mobile service acknowledges that reality by offering flexible scheduling that adapts to the client’s pace rather than forcing the client to adapt to the shop’s rhythm. This mutual respect—between the customer’s time and the technician’s expertise—builds trust that extends beyond a single appointment. There is an implicit promise that the relationship will reward future interactions with consistent, predictable performance, which is crucial for a service model that relies on repeat business and word-of-mouth referrals.

The human element is never abstract in this narrative. The company’s commitment to professionalism is evident in the way technicians carry themselves, the way they communicate, and the way they handle feedback. A client who provides input about a repair plan does not feel dismissed; instead, their insights become part of a shared plan. The service record is digital and accessible, enabling clients to review prior work, understand what has been done, and set expectations for what comes next. This continuity matters when a vehicle requires ongoing maintenance; a logical sequence of services becomes a story, not a series of disjointed events. The ability to view past inspections and upcoming recommendations helps customers feel in control, which reduces uncertainty and fosters a sense of partnership with the service provider.

Feedback emerges as a steady current guiding continuous improvement. The organization actively seeks input from customers, not as a formal obligation but as a meaningful channel to refine operations. When a client notices a minor inconvenience or suggests a slight adjustment in process, the team treats it as an opportunity to enhance the experience for everyone. The feedback loop is closed with follow-up communications that acknowledge concerns, explain corrective steps, and confirm when changes have been implemented. This practice is more than courtesy; it is a structural element that sustains quality and trust over time. In a market increasingly driven by convenience, a customer-focused feedback culture becomes a competitive differentiator. The Google reviews cited in the chapter’s sources serve as a visible repository of real experiences, capturing the nuances of what clients value most: reliability, clarity, respect, and genuine care for their time and safety. The reviews also function as a quiet accountability mechanism, reminding the team that every appointment is a chance to demonstrate consistency and excellence.

Behind the scenes, technology and scheduling systems play a quiet but essential role. The operation uses modern digital tools to optimize routes, allocate technician time, and synchronize parts fulfillment with the diagnostic plan. This is not about replacing human judgment with software; it is about strengthening human judgment with timely information. Real-time updates about the estimated time of arrival, the status of diagnostic tests, and the readiness of parts reduce the friction that often accompanies mobile service. When a client asks for an amendment to the plan—perhaps a second diagnostic or an adjustment to the scope—the system can present the options alongside their implications for cost and time. The result is a consultative experience that preserves the client’s autonomy and secures the best possible outcome for the vehicle.

Quality assurance, a cornerstone of any reliable service, is woven into the mobile model through standardized procedures and post-visit follow-ups. The technicians complete service checklists that verify essential safety features and operational readiness, then share a concise report that highlights what was done, what is recommended next, and why. The post-service communication reinforces the day’s work with practical maintenance guidance. It becomes a bridge to future interactions, inviting the client to schedule follow-ups at a time that fits their calendar. Such continuity is particularly valuable for busy families or professionals who rely on predictable maintenance cycles to avoid unexpected breakdowns. It also helps the service provider allocate resources more efficiently, aligning demand with capacity and reducing the trial-and-error cycle that can erode client confidence.

The professional ethos that underpins the experience is rooted in respect for the client’s time, property, and safety. The technicians carry themselves with courtesy and demonstrate meticulous attention to safety protocols. They explain safety considerations in straightforward language, ensuring clients understand why certain steps require the precautions they do. This transparency reduces questions about risk and reinforces the perception that the service is not only convenient but also responsible. The client does not feel rushed; rather, they feel consulted, empowered, and cared for. In the long run, this combination of courtesy, competence, and clear communication strengthens loyalty, which is visible in repeat visits and robust referrals.

In examining the broader implications of this approach, the mobile model aligns with a growing preference for service delivered on demand, without the logistical overhead of travel and time spent in a shop. The experience is not simply a feature; it is a fundamental design choice that shapes how clients perceive value. When the service arrives at the client’s location, it becomes more than a repair event. It becomes a demonstration of respect for how people live, work, and move through their day. The narrative of customer experience thus emerges as a central argument for the viability and resilience of mobile vehicle care in a marketplace where convenience, consistency, and trust are essential.

For readers seeking related automotive insights that complement this discussion, the KMZ Vehicle Center blog offers additional context on how mobile service models intersect with routine maintenance strategies, diagnostics, and best practices for vehicle care in urban environments. KMZ Vehicle Center blog

External resource: The value and reception of on-site vehicle care are also reflected in public feedback channels that highlight the human element of the experience. External perspectives underscore the importance of reliability, clear communication, and fair pricing in shaping customer satisfaction and word-of-mouth recommendations. External reference: https://www.google.com/search?q=A+Anthony%27s+Mobile+Vehicle+Services+reviews

Chapter 3: Turning the Corner—On-Site Auto Care Reconfigures Laurel’s Local Automotive Market

In Laurel, Maryland, the arrival of on-site automotive care has quietly redefined what customers expect from a neighborhood service industry. The practice of bringing skilled maintenance and repair directly to a customer’s home or workplace has evolved from a novelty to a dependable standard, and its impact on the local automotive market is best understood as a multi-layered reconfiguration. On a practical level, the service model reorients the entire flow of automotive care from a fixed location to a mobile, responsive system. It shifts the point of friction—time, convenience, and trust—from the consumer to the service provider, and in that shift lies a compelling case study for how a single mobile operation can influence market norms in a mid-sized urban-suburban corridor. A. Anthony’s Mobile Vehicle Service, based at 14711 Baltimore Ave, Laurel, MD, embodies this trend by delivering professional maintenance and inspections on site, a choice that resonates with a clientele that values flexibility as much as reliability. The business hours, concentrated on Mondays with two productive windows from 8:30 am to 12:30 pm and 1:30 pm to 5:30 pm, are more than a schedule. They symbolize a deliberate alignment of capacity with the rhythms of daily life—school runs, work shifts, and the sudden moments when a vehicle must be ready for the week ahead. The model’s emphasis on accessibility is not merely a convenience; it is a strategic proposition that integrates time savings with trusted expertise, a combination that changes how people plan, budget, and decide where to invest in their vehicle’s health over the long term.

The market shift is visible in the way customers explain their choices. The appeal of a service that arrives at a driveway or a parking lot—rather than requiring a car to endure a potentially lengthy trip to a shop—speaks to broader consumer preferences for personalized, low-friction experiences. This preference is a hallmark of the modern service economy, where consumers rank convenience alongside price and quality. A. Anthony’s Mobile Vehicle Service reinforces this with a professional presentation: courteous engagement, clearly defined tasks, and a transparent approach to pricing that helps the customer gauge value before any work begins. The operational philosophy mirrors what many urban households needed but had not always found in traditional shops: a reliable partner who respects time, prioritizes clear communication, and treats the vehicle as a system of interdependent components rather than a collection of fix-it tasks. A photo gallery of 103 images available online offers tangible evidence of the work in action, from routine maintenance to diagnostic procedures, underscoring the practitioner’s commitment to visible quality. This visual portfolio not only serves as social proof but also helps potential clients visualize what on-site care can look like when delivered with discipline and precision.

The local competitive landscape responds to this model in meaningful ways. The mobile service’s ability to deliver on-site care creates a benchmark for reliability and responsiveness that fixed-location shops must reckon with if they aim to retain and grow their customer base. Price fairness, a cornerstone of the service’s market stance, becomes a differentiator in a field where trust often precedes technical capability. When a client witnesses the work being performed in real time and sees a transparent estimate before labor begins, the perceived value of on-site care rises. In this sense, the mobile model is not just a convenience; it is a credible alternative to the traditional car care path that pushes competitors to refine their customer service, turnarounds, and communication protocols. The impact on consumer expectations is gradual but measurable: people start to anticipate flexible scheduling, proactive communication, and a responsive service footprint that can adapt to the realities of busy lives rather than requiring them to contort their schedules around a shop’s constraints.

With evolving expectations comes a broader invitation to innovate. A. Anthony’s Mobile Vehicle Service exemplifies a trend toward integration of digital tools with hands-on expertise. In markets where mobile service is expanding, digital booking systems, remote diagnostics, and the capacity to deliver real-time updates become not merely add-ons but essential elements of service design. The on-site model amplifies the importance of accurate diagnostics in a mobile context, where returning a vehicle to the shop simply isn’t the default path. Real-time communication about the vehicle’s status, preliminary findings, and scheduling adjustments strengthens the consumer’s sense of control and confidence. The broader market reaction to such innovations is a ripple effect: more shops are compelled to offer online appointment platforms, clients expect clear pricing before work starts, and service records gain an enduring utility as digital logs that can be accessed across multiple visits or even across households.

What this means for the local market is a transformation in the expectations consumers bring to the car care category. Convenience is not a peripheral benefit; it is a core driver of how people select providers. When a business regularly meets a customer where they are, it becomes a trusted partner in daily life rather than a distant vendor requiring the customer to alter plans. This transition has implications for how service capacity is measured and managed. A. Anthony’s operates within defined time blocks, yet the broader implication is a demonstration that time is a legitimate service product in itself. Clients gain back hours that would otherwise be spent commuting, waiting, or shuffling schedules for vehicle maintenance. The currency here is time, and the return on that time is an enhanced sense of reliability and predictability about vehicle health. In an urban or semi-urban environment where roadways, parking constraints, and work demands can complicate routine maintenance, the value proposition of mobile care grows even stronger—especially for fleets or households juggling multiple vehicles.

The market also experiences a normalization of trust-building through visibility. The online gallery of work, together with the on-site presence, builds a narrative of competence that customers can verify in real time. Trust, in the service economy, is often cemented by visible practice—cleanliness, organization, and a methodical approach to problem-solving. When a technician arrives with a clearly defined plan, presents a concise diagnostic framework, and completes the service with explicit test results, the customer perceives a level of accountability that might be less tangible in a conventional shop setting. The combination of professionalism, time efficiency, and transparent pricing creates a durable impression that can translate into repeat business and word-of-mouth referrals, both of which are vital in shaping a stable local market foothold.

From a strategic vantage point, the A. Anthony’s model acts as a catalyst for sector-wide introspection. The local garages, which provide a fixed-point alternative, are pressed to rethink not only their pricing and scheduling but also their service mix and accessibility. The prospect of real-time diagnostics, flexible dispatch, and an expanded range of on-site tasks becomes more than a futuristic possibility; it increasingly resembles a near-term standard. Even if not every shop adopts the same full on-site approach, the competitive pressure pushes the market toward a higher baseline of customer service. This dynamic is particularly relevant in communities where households and small businesses require rapid, reliable maintenance to keep vehicles on the road without disrupting daily operations.

Looking ahead, the evolution of on-site care in Laurel hints at further market transformation driven by technology and consumer preference. The push toward digital interfaces, particularly in booking and communications, can lead to more predictable scheduling, improved technician utilization, and more accurate cost estimates. Such efficiencies have a compound effect: as more customers recognize the value of on-site care, the demand for mobile services expands, potentially encouraging more technicians to embrace flexible work models, portable diagnostic tools, and standardized protocols. The broader implication is a shift in how the local automotive ecosystem defines accessibility. It becomes less about proximity to a shop and more about the ability of a service provider to meet a vehicle where it is and to deliver a level of care that resonates with the rhythms of contemporary life. In this light, the chapter’s core observation is simple yet profound: when a mobile care model reliably blends expertise with convenience, it does more than capture a share of the market. It reframes what customers expect from automotive maintenance, thereby nudging the entire sector toward greater adaptability and trust.

For readers seeking further context on practical maintenance insights that echo the spirit of accessible care, the KMZ Vehicle Center blog offers a repository of guidance that complements what mobile providers deliver in the field. It presents a curated set of tips designed to help readers plan maintenance, understand diagnostic signals, and navigate routine upkeep with greater confidence. See https://kmzvehiclecenter.com/blog/ for more. The chapter’s narrative remains anchored in the lived experience of Laurel’s households and businesses, many of whom rely on a dependable vehicle to fulfill daily responsibilities, travel, and professional commitments. In that regard, on-site automotive care does more than reduce the effort required to service vehicles; it reinforces a philosophy that values responsiveness as a product in its own right.

The social dimension of this transition should not be overlooked. A mobile service model can enhance inclusivity by reaching segments of the population that would otherwise incur greater costs or logistical burdens to access traditional shops. The ability to service a vehicle at home or on location reduces barriers related to transportation, childcare, and work obligations. This accessibility aligns with broader urban governance goals that prize efficiency, reduced congestion around fixed-location facilities, and improved quality of life. It also invites discussion around workforce development in the local area: skilled technicians who can operate in varied environments, communicate clearly with customers in already stressful moments, and manage a spectrum of tasks in a single visit contribute to a more versatile and versatile local economy. The result is not merely a shift in where maintenance happens; it is a shift in the social contract between service providers and the people they serve.

As the market absorbs these changes, the long-term picture becomes clearer: mobile care is less a niche format and more a durable channel through which maintenance, inspection, and minor repairs can be integrated into everyday life. The Laurel example demonstrates how a disciplined, customer-centered mobile model can influence expectations, discipline competition, spur innovation, and ultimately raise the standard of care. The conversation moves from a debate about convenience to a robust assessment of reliability, accessibility, and trust. When customers can rely on a technician to arrive on schedule, perform work with transparency, and leave a vehicle in better condition than before, the market responds by elevating both the measurement and the meaning of value. The broader automotive landscape—whether viewed through the lens of urban service delivery, consumer experience, or competitive dynamics—begins to mature around this principle: care delivered where it matters most, with clarity and accountability woven throughout every interaction.

External resource: https://www.anthonysmobilevehicleservice.com

Chapter 4: From On-Site Fixes to Intelligent Mobility: Future Trends Shaping A. Anthony’s Mobile Vehicle Service

A. Anthony’s Mobile Vehicle Service stands at the cusp of a broader evolution in how people think about car care, mobility, and the value of service in the automotive lifecycle. The coming years are less about stacking more repair tasks into a day and more about weaving a responsive, data-driven ecosystem that keeps vehicles healthy, safe, and productive wherever they roam. The core shift—from treating the car as a discrete product to treating mobility as a continually delivered service—is not simply a marketing reframing. It is a redesign of how a small, on-site operation can scale its impact, deepen trust, and create lasting value for customers whose schedules, homes, and workplaces are increasingly blended into a single daily map. In this new landscape, A. Anthony’s can become more than a mobile mechanic; it can become a partner in the vehicle’s entire life, delivering maintenance, monitoring, and optimization as a cohesive service that travels with the customer rather than demanding its own visit to a shop.

The most persuasive force behind this transition is the rapid expansion of vehicle software and connectivity. Vehicles today collect an immense stream of data—from engine health and tire pressure to battery status and thermal conditions. The on-site service model that A. Anthony’s operates within is uniquely positioned to leverage this stream. Instead of waiting for a customer to bring the car in, the business can adapt by offering on-site diagnostics that read and interpret sensor data in real time, then propose a tailored maintenance plan. This is where the service-over-product paradigm becomes tangible. A customer does not simply pay for a repair; they subscribe to a proactive care plan that minimizes breakdowns, optimizes performance, and aligns with the customer’s calendar. In practice, that means turning a one-off service call into a scheduled sequence of preventive checks, software updates, and battery health assessments that can be completed on-site during a single or a few coordinated visits.

A pivotal enabler of this future is remote diagnostics. Connected vehicles generate alerts long before a fault becomes visible at the wheel. For a mobile service provider, remote data can forecast what needs attention and when, enabling scheduling precision that reduces downtime for customers and improves technician utilization. The potential for integration grows when service data is fused with routing intelligence. Imagine a system that not only detects a tire pressure anomaly but also routes the technician with the smallest travel time impact to that vehicle, while simultaneously coordinating with a nearby client for a secondary inspection or a routine maintenance window. The efficiency gains are not theoretical; they reflect a natural extension of a mobile model that already thrives on convenience. The next step is to embed predictive maintenance into the core value proposition. By analyzing patterns in temperature cycles, wear indicators, and usage history, A. Anthony’s can anticipate component fatigue and arrange preemptive servicing before a failure disrupts the customer’s day.

This shift toward a predictive, on-demand service framework also alters how customers perceive cost and value. The traditional repair bill—involving parts, labor, and a fixed appointment—gives way to a transparent, flexible pricing model that reflects actual risk and anticipated needs. Some customers will gravitate toward simple, fixed maintenance bundles, while others will prefer usage-based or subscription-based plans that cover routine inspections, consumables, and software updates. The Deloitte 2035 mobility outlook emphasizes that the most durable profit pools will come from services, software-enabled offerings, and data-driven insights rather than pure hardware sales. For a mobile operator like A. Anthony’s, this translates into designing service configurations that are modular, scalable, and resilient to market swings. The on-site model already minimizes the friction of taking time off work or arranging rides to a shop; combining that with a transparent, subscription-friendly pricing approach can intensify loyalty and extend the customer relationship across multiple years of vehicle ownership.

Autonomy, too, reshapes the possible value stream for mobile care. As Level 3 and Level 4 autonomous driving gradually become a practical capability in more fleets and passenger vehicles, the need for vigilant maintenance, software validation, and safety-critical checks rises. A mobile service provider is uniquely suited to be the last-mile guardian of an autonomous fleet’s reliability. Rather than waiting for a consumer to notice a warning light, technicians can operate as a preventive care partner, conducting routine recalibrations, software patches, and sensor alignments on-site, and coordinating with fleet operators to ensure vehicles are always ready for the next trip. The service model thus expands beyond simple repairs to include a proactive monitoring role, leveraging remote telemetry to anticipate issues before they become costly downtime events. In this vision, vehicles become mobile living spaces that entrust something beyond the physical hardware to the hands that maintain them—the hands of a trusted service partner who understands the rhythms of a busy life and the demands of modern fleets.

The mobility ecosystem is also moving toward Mobility-as-a-Service, where ownership is eclipsed by usage, and fleets—whether corporate or shared—demand end-to-end lifecycle management. For A. Anthony’s, this means reframing its offer from a one-off visit to a comprehensive fleet service that can manage procurement, maintenance, charging infrastructure, and end-of-life recycling for corporate customers as well as smaller operators. The implications are profound: the business must become adept at interfacing with fleet management platforms, integrating with charging networks, and coordinating maintenance windows that align with a company’s operations. It is a shift from being a local repair specialist to becoming a strategic partner in the mobility lifecycle. By embracing this broader scope, the company can position itself to win larger contracts, expand its geographic reach through mobile units, and cultivate ongoing revenue streams that are less volatile than episodic repair work.

The energy and digital ecosystems composing future mobility press hard on the need for a holistic integration strategy. Electrification of fleets is accelerating, and the infrastructure that supports charging, battery health monitoring, and energy cost optimization will become a standard service layer. Even for a mobile provider currently focused on conventional powertrains, the long arc of electrification means developing competence in battery diagnostics, charging hardware on-site adaptations, and safety protocols for high-voltage systems. The digital layer—parking, insurance, shopping, entertainment, and more—will converge with the vehicle’s own systems to create a seamless experience. For a customer, it should feel natural to schedule a service appointment alongside a parking reservation or a maintenance reminder that automatically triggers a loyalty reward or discount across related services. The integration challenge is not merely technical; it is organizational. It requires alignment with digital platforms, data-sharing agreements that protect privacy, and open standards that let different service providers plug into a single customer experience without friction.

In this evolving system, data and AI become the currency of advantage. A. Anthony’s can deploy AI that learns from a wide set of customer patterns, vehicle configurations, and local driving conditions. Predictive maintenance becomes smarter when it is informed by aggregated anonymized data across the service network, allowing more accurate forecasting of component lifecycles and better scheduling. AI can optimize routing to minimize travel time and fuel use, assign the most appropriate technician for a given repair scenario, and personalize customer communications so that reminders feel timely and relevant rather than generic marketing. The ethical and practical guardrails around data use—consent, privacy, security—will be as important as the data itself. As the industry moves toward becoming an AI-driven service provider, the operating model must emphasize responsible data stewardship, robust cyber defense, and transparent customer controls. The promise is powerful: a service experience that feels anticipatory and almost invisible in its competence, yet deeply supportive of the customer’s life rhythms.

To realize this vision, A. Anthony’s will need to chart a practical path that remains faithful to its core strengths—responsiveness, reliability, and a clear customer-first orientation—while gradually expanding capabilities. The first steps involve investing in telematics-enabled diagnostic tools, secure data channels, and mobile units that can handle both traditional repairs and software-enabled maintenance tasks. This investment unlocks the possibility of remote triage, where a technician can determine whether a visit is necessary, pending a virtual fix, or if a parts drop is required to complete a repair on-site. A disciplined approach to pricing and packaging will accompany these technical investments: bundled maintenance plans, flexible subscription options, and transparent, outcome-focused pricing that aligns with customers’ expectations for convenience and fairness.

An important part of the transition is communication. Customers must understand the value of a service that monitors their vehicle’s health and can intervene before a breakdown occurs. Clear messaging about the benefits of predictive maintenance, the peace of mind from remote diagnostics, and the convenience of on-site service will help build trust. A. Anthony’s can reinforce this with stories of real-world outcomes—reduced downtime, fewer unexpected costs, longer vehicle life, and a smoother daily routine for busy families and professionals. The business can also leverage digital touchpoints to keep customers informed about upcoming service windows, battery health statuses, and energy optimization tips that align with seasonal changes and driving patterns. The path is not a single leap but a series of coordinated improvements that align technology, operations, and customer experience into a cohesive whole.

For readers seeking a broader window into how mobility providers are positioning themselves for the next decade, the broader industry analysis points to two practical realities. First, the value pool is increasingly tied to service, software, and data rather than hardware alone. Second, the ability to deliver intelligent, integrated experiences hinges on robust digital platforms, secure data practices, and the willingness to collaborate with fleets, municipalities, and other mobility stakeholders. These insights resonate with A. Anthony’s own strengths as a customer-centered, on-site service—an organization that can scale its hands-on craft while embracing digital tools that expand its reach and resilience. The chapter’s arc therefore invites researchers and practitioners to imagine not just a business that fixes cars on the curb but a small service company that anchors a larger mobility ecosystem, guiding vehicles through a lifecycle that is intelligent, connected, and sustainable.

In the spirit of shared learning, consider the practical example of how the KMZ Vehicle Center Blog often frames evolving service models and maintenance philosophies as part of a broader customer experience strategy. A reader can explore perspectives on maintaining complex systems in a way that mirrors the service philosophy described here. KMZ Vehicle Center Blog This emphasis on accessible knowledge underscores a simple truth: as mobility grows more intricate, the value of a trusted on-site partner who can translate data into actionable care remains foundational. The challenge for A. Anthony’s is to translate that foundation into a scalable, durable business model that preserves the personal touch that defines mobile service while embracing the efficiency and foresight that larger platforms demand. As the industry shifts toward autonomy, MaaS, and integrated energy ecosystems, small operators can still shape the future by staying close to customers, delivering reliable care, and continually weaving new capabilities into the fabric of daily mobility.

The road ahead will require patience and iteration. The most successful players will be those who combine hands-on expertise with disciplined data stewardship, who treat each service visit as part of a longer relationship, and who build a service architecture that can adapt as technology, policy, and consumer expectations evolve. For A. Anthony’s, this future is not a distant horizon but an evolving map—one where a curbside repair becomes a gateway to a fully integrated mobility experience. The journey will unfold through careful pilots, consistent customer feedback, and a steady expansion of capabilities that maintain the core promise: service wherever you are, with intelligence that respects your time and your vehicle’s health. External references to industry outlooks, including the Deloitte 2035 Mobility Outlook, provide a macro lens on these shifts and reinforce the strategic importance of moving beyond repairs toward comprehensive mobility management. https://www2.deloitte.com/insights/us/en/focus/industries/automotive/2035-mobility-outlook.html

Final thoughts

A. Anthony’s Mobile Vehicle Service is more than just a convenient alternative to traditional auto repairs; it represents a fundamental shift in how vehicle maintenance is approached. By prioritizing customer satisfaction and adapting to the rapid changes in consumer expectations, A. Anthony’s remains at the forefront of the mobile service revolution. With an emphasis on quality, reliability, and convenience, the company not only meets the needs of local car owners and businesses but also sets the stage for the future of automotive service delivery.