For car owners, whether you’re a local private enthusiast or a small business fleet operator, understanding the importance of a vehicle service contract is crucial. This structured agreement not only ensures regular maintenance but also defines the scope of services, associated costs, and responsibilities shared between you and the service provider. Each chapter delves into a key component of vehicle service contracts, from the core services offered to the financial and legal implications, ensuring you have the information you need to make informed decisions. By the end of this article, you’ll be equipped with knowledge that helps protect your investment and keeps your vehicle in optimal condition.

The Core of Care: Understanding What Vehicle Service Contracts Really Cover

A vehicle service contract’s true value rests in its core services—the regular care and essential repairs that keep a vehicle running smoothly long after the factory warranty has expired. When owners think about a service contract, they often picture it as a safety net for big, unexpected failures. In practice, the backbone of these agreements is the ongoing maintenance and the routine repairs that prevent small problems from becoming costly breakdowns. Core services are not just a checklist; they are an explicit promise about how the vehicle will be cared for over time, with a defined cadence, a clear scope, and a predictable cost structure that helps a family or a fleet plan ahead.\n\nAt the heart of any vehicle service contract is the scope of work. This part of the agreement spells out exactly which services will be performed and under what circumstances. Routine maintenance is the most visible component: oil changes, filter replacements, brake inspections, tire rotations, belt and hose checks, fluid top-ups, and battery tests. These tasks are the daily discipline that keeps engines efficient, brakes responsive, and steering predictable. When a contract describes these tasks, it is laying down a maintenance rhythm—an expected cadence that aligns with either time intervals or mileage milestones. For example, a contract might set annual maintenance for government or fleet vehicles, ensuring regular checks with a standardized procedure. The practical effect is peace of mind: the vehicle is not left to chance, and the owner does not have to chase the next service window or negotiate price at every visit.\n\nBeyond the basics, core services often extend to more involved maintenance and certain repairs that the contract covers under its umbrella. This can include more complex work such as engine overhauls, transmission repairs, cooling system servicing, or comprehensive safety inspections. The boundary between maintenance and repair in a service contract can feel subtle, but the contract’s wording makes the distinction explicit. Routine maintenance stays within the agreed cadence, while repairs address components that fail or degrade beyond normal wear while the contract is active. The line matters because it helps owners anticipate costs and plan for the future, rather than facing an open-ended bill every time a vehicle experiences a hiccup.\n\nThe service period is the heartbeat of the arrangement. Most contracts define a term—often a year or multiple years—during which the covered services and costs apply. This duration matters for budgeting and for scheduling. A longer term can lock in predictable pricing and give fleet managers leverage to plan maintenance over multiple fiscal cycles. A shorter term might offer more flexibility or a tighter focus on immediate needs. Either way, the period is a commitment that the provider will deliver services in a timely manner and that the owner will deliver the vehicle for service when requested. A well-structured term aligns maintenance expectations with the vehicle’s lifecycle, so owners do not outgrow the coverage before the vehicle does.\n\nCost structures in core services are crafted to balance predictability with the reality of mechanical wear. The common models include flat fees per service, fixed monthly or annual rates, or price per unit of work. Some contracts, often labeled as framework agreements, bundle multiple services at a pre-negotiated rate. This structure allows the owner to forecast maintenance spending with a high degree of certainty, reducing the surprise factor when a service is due or when a more significant repair becomes necessary. The financial predictability is a major reason many owners choose a service contract: it converts uncertain maintenance costs into a steady, manageable expense that can be incorporated into budgets, warranties, or fleet accounts.\n\nA central element of core services is the allocation of responsibilities. The contract explicitly assigns duties to the service provider and to the vehicle owner. The provider assumes responsibility for performing the work to agreed standards, using appropriate, quality parts, and meeting service deadlines. The owner’s obligation is to deliver the vehicle in a timely fashion and to pay the agreed fees. This mutual clarity reduces disputes and helps both sides measure performance against the contract. It also encourages a collaborative relationship: the provider may offer reminders about upcoming maintenance or discuss performance concerns, while the owner benefits from a transparent schedule and a clear path to resolution if service quality falters.\n\nQuality assurance and guarantees are the trust marks of core services. Many contracts include some form of guarantee related to the work performed and the parts installed. A common model is a guarantee that covers the workmanship, the replacement parts, and the subsequent function of the repaired system for a defined period or mileage threshold. Some providers extend a broader warranty on components and labor, offering coverage that protects against recurring failures or latent defects. This assurance is crucial because maintenance, while preventive, is not infallible. The guarantee gives owners confidence that the contract stands behind the promised level of care and that a misstep will be addressed without excessive cost to the owner. When reading a contract, it is worth noting how guarantees are defined, what the exclusions are, and how claims are processed.\n\nTermination and dispute resolution are also part of the fabric of core services. The contract will outline how either party may end the agreement and how disagreements will be resolved, often in negotiation or, if needed, through a formal dispute process in a specified jurisdiction. Clear mechanisms for termination prevent stalemates, while a defined path for dispute resolution helps preserve the relationship between owner and provider even when issues arise. This aspect is not merely legal boilerplate; it shapes daily experiences—how service delays are handled, how credits or reimbursements are issued, and how quickly a problem is rectified.\n\nThe value of core services extends beyond the mechanics of maintenance and the letters on a page. It is about the discipline of care that a vehicle receives under a structured program. The contract frames maintenance as an ongoing dialogue rather than a series of one-off fixes. It encourages adherence to a maintenance schedule that supports engine longevity, reliable braking performance, and predictable operation in varied driving conditions. In practice, a robust core-services framework helps owners avoid the two most common maintenance misalignments: delays in required service and unanticipated costs when a major system finally needs attention. With a well-designed contract, the owner can anticipate the timing of services, align them with vehicle usage, and budget for the associated costs without sacrificing safety or performance.\n\nA practical thread running through core services is the emphasis on measurable standards. The contract typically requires work to be performed to recognized industry standards, with the use of quality parts and calibration to factory specifications. The focus on standards matters because it anchors the provider’s responsibilities in a shared language of quality. For fleet managers, this alignment translates into consistent performance across dozens or hundreds of vehicles. For individual owners, it translates into a reliable experience: a predictable maintenance routine that minimizes the risk of breakdowns, even as the vehicle ages.\n\nFinally, the nuanced reality of core services is that coverage levels can be tailored. A vehicle service contract often offers tiers such as powertrain coverage, which focuses on the engine, transmission, and drivetrain; bumper-to-bumper coverage, which aims to cover most components with certain wear and tear exclusions; and basic coverage, which provides a narrower band of protection. Each tier shapes the core services differently. A more comprehensive level may cover a broader set of maintenance items and repairs, with more generous guarantees, while a leaner option can reduce cost but require owners to assume a greater share of ongoing maintenance decisions. Choosing the right level means weighing the vehicle’s age, reliability history, driving conditions, and the owner’s tolerance for risk against the price and convenience of bundled services.\n\nThe idea of core services is not to obscure risk but to manage it through structure and foresight. It is about turning unpredictable maintenance costs into a manageable, transparent plan that fits a given budget and life pattern. As maintenance needs evolve, the contract should adapt—allowing the owner to adjust the scope, extend service periods, or recalibrate cost arrangements in a way that remains fair and practical for both parties. The outcome is more than financial predictability; it is the reassurance that the vehicle’s health is being actively watched, regulated, and maintained by professionals who share a commitment to long-term reliability. This is the essence of a well-crafted vehicle service contract: a living plan that acknowledges the realities of vehicle aging while offering a steady, dependable path to care.\n\nTo connect this focus to practical planning, consider the maintenance rhythm you already follow or intend to adopt for your vehicle. For routine tasks like oil changes and brake inspections, the cadence should align with your driving habits and the manufacturer’s recommendations, a topic that often appears as guidance on oil-change intervals and time-versus-mileage planning optimal oil change intervals: time vs mileage. Integrating that cadence into your contract’s scope of work helps ensure the core services actually match daily use. If you’re managing a fleet or a family’s vehicles, this alignment becomes even more critical, because it translates into predictable downtime, consistent maintenance costs, and less friction when service is needed. In the end, the core services are the quiet engine of the contract—ensuring that care is continuous, costs are predictable, and performance remains reliable as the miles accumulate. Only with that foundation can a vehicle service contract truly deliver the peace of mind it promises, and only then can owner and provider collaborate as partners in the vehicle’s ongoing health.\n\nFor readers seeking broader guidance on how these contracts work, Consumer Reports offers a detailed overview of what a vehicle service contract entails, including coverage details and exclusions, which can help inform your evaluation as you weigh options and plan ahead.

Defining the Boundary Lines: A Deep Dive into the Scope of Work in Vehicle Service Contracts

A service contract on a vehicle is more than a long list of repairs or a collection of discounts. It is a carefully drawn boundary around what the provider will do, when they will do it, and how much it will cost. The scope of work is the heart of that boundary. It translates the idea of ongoing care into concrete promises: the tasks that will be performed, the cadence of those tasks, the standards that must be met, and the limits that protect both parties from drift. When a vehicle owner signs a service contract, they are not merely purchasing labor or parts; they are purchasing a framework for maintenance and accountability. The scope of work is what prevents ambiguity from creeping into a relationship that hinges on trust, timing, and technical proficiency. Read correctly, it is the part of the contract that turns a maintenance plan into a predictable, navigable program for vehicle health over time.

At its core, the scope of work lays out two intertwined dimensions: the types of services covered and the way those services are delivered. On the service side, the document enumerates routine maintenance tasks alongside diagnostic checks and potential repairs. Routine maintenance is the backbone. It covers the predictable, scheduled care that keeps a vehicle running smoothly and safely. Oil changes, tire rotations, and fluid replacements are staples in most scopes because they prevent small problems from turning into major ones. A well-drafted scope will specify not only that these tasks are included but also the expected depth of each task. For example, an oil change might be defined as replacing the oil and the filter, inspecting related systems, and confirming there are no leaks or abnormal wear. The same level of specificity applies to tire rotations, brake fluid tests, and filter replacements. The scope should be precise enough to avoid disputes about whether a particular service was included in the contract or charged separately outside of it.

Beyond routine maintenance, the scope addresses diagnostic checks and repairs. Diagnostic work is essential because modern vehicles rely on interconnected systems and onboard diagnostics. The contract may outline that the provider will perform standard diagnostic scans, assess warn‑tire indicators, interpret fault codes, and recommend corrective actions. When the scope includes repairs, it often covers major components such as the engine, transmission, or braking system, but with caveats. The language typically distinguishes between what is proactively maintained under the contract and what constitutes a separate repair outside the scope due to unforeseen catastrophic failure or extreme wear. This distinction helps prevent disputes about whether a problem is the result of normal operation or a new, unexpected failure.

A central element of the scope is the frequency and cadence of service. It is common for contracts to require service at fixed intervals or mileage milestones. These schedules translate the annual calendar into a practical calendar for vehicle health. A contract might specify maintenance every 5,000 miles or every six months, whichever comes first, and it may set different cadences for different vehicle types or usage scenarios. The frequency is not a cosmetic detail; it governs cash flow, technician availability, and the timing of inspections that can catch problems before they escalate. The cadence also interfaces with other parts of the contract, creating a rhythm that owners can plan around and technicians can uphold with discipline. For readers seeking a deeper look at how maintenance intervals influence the broader maintenance plan, see the article on optimal oil change intervals and the balance between time and mileage.

The details about parts and labor form another cornerstone of the scope. The contract will specify whether original equipment manufacturer parts or aftermarket components will be used, and it will set expectations for quality, compatibility, and warranty. Parts quality matters not only for immediate performance but for long-term reliability and the likelihood of repeat service under the contract. Labor rates—how much is charged per hour or per task—are also part of the scope. The document should spell out the base rate, how overtime is handled, and whether there is a tiered pricing structure for different kinds of work. When a contract is framed around a price per unit of work or a bundled set of services, the scope must clearly define what qualifies as a unit and how bundled services are priced. Clarity here reduces the risk of disagreement when the vehicle requires multiple tasks at once or during a single service visit.

Equally important are the exclusions and limitations embedded in the scope. No contract can anticipate every possible contingency, and the scope must explicitly state wear-and-tear items that are not covered. Items like brake pads, wiper blades, and certain cosmetic components commonly fall outside core maintenance coverage or are subject to separate terms. The exclusions do more than shield the provider from unforeseen liabilities; they also guide the owner toward informed decision‑making about maintenance priorities and budgeting. A well-constructed scope acknowledges that some items will wear out with use and will need replacement outside the contract, and it helps owners plan for those eventual costs rather than being surprised during a service visit.

The scope of work is not merely a shopping list; it embodies the service philosophy of the provider. It expresses standards of performance, the expected quality of parts, and the timelines within which tasks should be completed. In a robust scope, quality assurance and guarantees have a clear home. A repair might come with a three-cell guarantee—a commitment to repair, replace, and compensate if the issue recurs within a defined period—or a warranty on parts and labor for a specified distance or time. Such guarantees connect the act of performing maintenance with accountability after the work is done. They create a feedback loop that encourages the service provider to meet standards and reassures the owner that the contract is more than a procedural commitment; it is a performance commitment.

The scope also interacts with the contract’s broader framework for dispute resolution and termination. If a party believes that the other has failed to meet the defined scope, the contract will typically provide a path to negotiate, mediate, or litigate in a particular jurisdiction. A precise scope makes it easier to determine whether a shortfall constitutes a breach and what remedies might be appropriate. Because maintenance and repair work touch every aspect of a vehicle’s reliability, the consequences of misalignment between expectation and delivery can be costly and disruptive. The clearer the scope, the less room there is for conflict when a vehicle owner asks why a certain service was or wasn’t performed, or why a given part was replaced under the contract rather than outside of it.

Understanding the scope also requires looking at it in relation to the service period. A contract that runs for a year or more must be able to tolerate cycles of wear, seasonal changes, and mileage accumulation. A robust scope anticipates these dynamics by balancing routine maintenance with periodic reviews, during which the owner and the provider reassess the vehicle’s condition, usage patterns, and evolving needs. It is not unusual for a multi-year agreement to include a renewal or amendment mechanism that revisits the scope in light of actual operating conditions, new vehicle technologies, or updated safety standards. In this sense, the scope is a living document designed to stay aligned with reality rather than serving as a static affirmation of intent.

For vehicle owners, the practical value of a well-defined scope is measured in clarity and predictability. It translates into a budget that is easier to manage because the maintenance tasks are mapped to a timetable, the parts are anticipated, and labor costs are laid out in advance. It helps owners choose coverage that matches their driving profile—from the predictable needs of a fleet vehicle to the variable demands of an everyday commuter. It also facilitates planning for potential upgrades or changes in the vehicle itself, whether due to new technology, evolving safety standards, or changes in how the vehicle is used. When owners understand the scope, they can compare contracts with confidence, not merely by headline price but by the depth and breadth of the care promised.

A practical cue for readers navigating this territory is to treat the scope as the spine of the contract. Everything else—frequency, cost structure, guarantees, and dispute mechanics—extends from it. In evaluating a potential agreement, owners should scrutinize how the scope defines routine maintenance versus major repairs, how it handles wear items, and whether the cadence aligns with their typical driving patterns. They should check the language around parts and labor quality, ensuring that the standards meet their expectations for reliability and longevity. They should also consider how the scope will adapt if the vehicle’s use changes, such as a shift from personal to commercial duties, or if a different type of maintenance becomes necessary due to environmental conditions or manufacturer advisories. The aim is not to minimize costs but to secure a maintenance plan that remains meaningful as the vehicle travels its life cycle.

For those who want to explore maintenance intervals in greater depth, a resource on maintenance timing can offer practical guidance without steering the reader away from contract considerations. See the discussion on Optimal oil change intervals: time versus mileage for an example of how interval decisions can influence both maintenance schedules and the perceived value of a service contract. It complements the scope by providing context for how owners can align their expectations with industry insights about preventative care. Optimal oil change intervals: time vs mileage.

In sum, the scope of work is where theory meets execution. It is the document that converts an idea about ongoing care into a concrete, actionable program. When written with care, it clarifies what will be done, how it will be done, when it will be done, and at what cost. It sets the stage for reliable performance, predictable budgeting, and a practitioner-wide standard of quality that both sides can trust. It is the lens through which a vehicle owner can evaluate whether a service contract will truly protect the health of the vehicle over time, or whether it will merely add a layer of complexity to a process that should feel straightforward: regular care, honest parts, fair labor, and a shared commitment to safe, dependable travel. For readers seeking broader regulatory or industry guidance on maintenance agreements, broader resources are available that discuss how commercial vehicle maintenance contracts are structured and enforced in practice. These references can help illuminate how the scope of work interacts with broader compliance standards and fleet management goals, ensuring that the contract remains robust across a range of operating environments.

The Service Period Unpacked: How Timing Shapes a Vehicle Service Contract

A vehicle service contract sits at the intersection of protection and planning. It is not merely a list of repairs your car might need in the future; it is a carefully defined window during which a provider agrees to cover eligible maintenance and repair work. That window is what the industry calls the service period, and understanding its start, end, and what is included within those bounds is essential to evaluating the true value of any service contract for a vehicle. The service period is not an afterthought. It shapes budgeting, risk, and even how you approach the routine care your car needs to stay reliable on the road. In practical terms, the service period is the defined duration—whether measured in time, mileage, or both—when the contract promises coverage for qualifying repairs or maintenance tasks. While the factory warranty guards you during the vehicle’s initial years or miles, the service contract steps in after that warranty expires, offering a buffer against the escalating costs of repairs and major components. This transition from warranty to extended coverage is where the service period gains its real significance, because it determines when you begin to rely on the contract to offset the price of repairs and maintenance rather than pay out of pocket or through a separate warranty plan. The exact mechanics of that period, though, depend on the terms you sign and the contract you choose, which is why reading the details on the start and end points is crucial before you commit.

One of the most important aspects to grasp is that the service period is often anchored to concrete milestones: dates on the calendar, mileage thresholds, or a combination of both. The period typically begins when the factory warranty ends, a moment that marks the official shift from manufacturer protections to the agreement you purchased with a service provider. In other words, as your car exits the warranty stage, the service contract takes effect and the clock starts ticking on coverage for eligible repairs and routine maintenance tasks. This can align with a vehicle’s odometer or a chosen calendar date, depending on how the contract is structured. In some plans, the start is fixed at a specific signing date, while in others it is triggered by the expiration of the factory warranty or by reaching a stated mileage milestone. The variety of triggers is why the precise wording matters so much; it is not enough to assume that coverage begins automatically at the end of warranty unless the contract explicitly says so.

The end of the service period is equally important. Coverage does not continue indefinitely; it terminates when the stated end date is reached or when the vehicle surpasses the mileage limit defined in the agreement. Some contracts use a hybrid approach, where both time and mileage contribute to the endpoint, and coverage ceases when either limit is hit. Others may cap the coverage by whichever milestone first occurs. The upshot is clear: if you push past the end point, you will incur out-of-pocket costs for repairs that would have fallen under the contract if they happened earlier. That makes it essential to know not just when your coverage starts, but when it ends, and to monitor your driving and maintenance so that you can plan for potential transitions in coverage as your needs change.

To navigate this effectively, buyers should look for explicit language in the contract’s terms that spell out the start and end points in plain terms. Terms such as “term of coverage,” “coverage period,” “effective date,” “expiration date,” or “odometer limit” are not mere legal boilerplate; they are the anchors that determine whether a repair qualifies as covered work. A common pattern is a fixed term measured in years after a specific start date, paired with a mileage cap. For example, a contract might promise coverage for a period of five years or up to 100,000 miles, whichever comes first. Others may set a calendar duration from the signing date or after the vehicle’s warranty ends, with a separate mileage cap. In any case, the contract should clearly indicate whether the period resets after a change in ownership, whether there are renewals, and how gaps in service—if any—are handled. The absence of clarity is a frequent source of disputes, so meticulous reading pays off in the long run.

From a budgeting standpoint, the service period is the lever that helps you predict and control costs. When you buy a service contract, you are essentially paying to cap the price of a defined set of services across a defined horizon. That predictability can be priceless for fleet managers, commercial operators, or individuals who rely on a car for daily work. The value often lies not only in the total amount paid but in how that amount maps to the maintenance and repair events you are most likely to encounter within the period. If you drive a lot in a region where road conditions stress suspensions, engines, and transmissions, a longer service period might be worth the additional premium. If your driving is lighter or more conservative, you may opt for a shorter period to avoid paying for coverage you won’t fully utilize. The strategic choice rests on reading your vehicle’s expected life cycle, your driving habits, and the likelihood of components failing as miles accumulate.

Another layer of complexity lies in how the service period interacts with maintenance schedules and the scope of coverages. The contract’s framework may bundle services like routine maintenance, inspections, and certain repairs into a single pricing structure, sometimes labeled as a framework agreement. In such cases, the service period governs not only repairs after failures but also the preventive work that becomes a condition of continued coverage. The period’s boundaries, therefore, influence how often you bring the vehicle in for service and how often you incur costs for items that are essential to keeping the vehicle within the covered zone. This makes the service period a central element in your overall maintenance philosophy, guiding when and how you perform maintenance, and how you decide whether to enroll in a contract at all.

For drivers who want to optimize the benefit, aligning maintenance tasks with the service period can turn a standard plan into a practical shield against rising repair bills. It is reasonable to plan routine tasks—oil changes, filter replacements, brake inspections, and tire rotations—so that they occur within the contract’s active window. When doing so, you may discover that certain preventive services performed at the right time contribute to smoother operation and fewer unexpected failures, which in turn supports a higher value from the service contract. To support this alignment, it can be helpful to consult guidance on maintenance intervals that balance time and mileage considerations. For example, discussions on optimal oil-change intervals that weigh time against mileage can illuminate how often you should schedule preventive work within the service period. This topic is explored in resources that emphasize the dynamic between time-based and distance-based maintenance, helping owners plan visits in a way that maximizes coverage benefits while minimizing unnecessary expenditures. optimal oil-change intervals (time vs. mileage).

As you assess a service contract, you should also consider how the service period fits with the contract’s other structural promises, such as guarantees, parts quality, and repair standards. A robust service period is only as valuable as the reliability of the coverage it governs. Some contracts promise a three-part guarantee that encompasses repair, replacement, and compensation, while others emphasize a warranty on parts and labor for a defined horizon. The interplay between timing and guarantees matters because it influences your expectations about what happens if a covered repair fails again or if a part is replaced and later fails under the same period. In practice, you want a contract that not only outlines when coverage begins and ends but also provides a reasonable path to resolution should a covered issue recur, ideally without lengthy disputes or delays. This reinforces the broader purpose of the service period: to offer predictable, manageable protection over a defined period, rather than a vague or uncertain commitment that leaves you guessing when coverage will apply.

Finally, the practical decision about choosing or negotiating a service period hinges on your vehicle’s ownership horizon. If you anticipate owning the vehicle for many years, or if the car will accumulate high mileage, a longer service period can be a prudent hedge against the escalating costs of major repairs. Conversely, if you plan to upgrade vehicles within a few years, a shorter service period or a plan with flexible renewal options might better match your lifecycle. The crucial step is to read the fine print, map the service period to your expected driving pattern, and assess how well the contract’s start and end points align with your warranty and maintenance strategy. The clarity you gain about when coverage starts and ends will empower you to project cash flows, set maintenance expectations, and avoid surprises when a repair bill would otherwise catch you unprepared.

For a broader, policy-centered perspective on service contracts, consider authoritative resources that outline how these agreements are designed to operate across the industry. These references can illuminate standard practices, lawful considerations, and consumer protections that shape the design of service periods. If you want to explore official guidance on vehicle service contracts, an excellent resource is the National Association of Auto Dealers, which offers comprehensive information on how service contracts work, including the intended role and limits of the service period. External resource: https://www.naad.org/vehicle-service-contracts.

In sum, the service period is more than a date on a contract. It is the practical backbone of a vehicle service contract, defining the window during which the plan deposits its protection into your hands. Understanding when that window opens, when it closes, and what happens inside its walls helps you evaluate the true value of a contract, plan your maintenance with confidence, and drive with a clear sense of the financial stewardship you are undertaking with every covered mile. By focusing on the timing, the coverage scope, and the alignment with your driving reality, you move from a passive purchaser of a plan to an informed owner who can navigate repairs and upkeep with clarity and peace of mind. And that peace of mind is precisely what a well-structured service period is meant to deliver.

Pricing the Road: Decoding the Cost Structure of a Vehicle Service Contract

A vehicle service contract is more than a price tag attached to a promise of repairs. It is a carefully designed financial instrument that translates risk into predictable costs, offering a shield against the unsettling prospect of major breakdowns when the warranty has expired. To understand its value, a reader must move beyond the headline price and explore how the parts of that price come together. The cost structure sits at the heart of any service contract on a vehicle because it reflects not just what is covered, but how coverage is delivered, under what conditions, and for how long. This is not a simple one-size-fits-all offer; it is a tailored arrangement that can be adjusted to the owner’s expected use, the vehicle’s demands, and the comfort level with potential out-of-pocket expenses. The chapter that follows digs into what actually drives the price, how the terms shape the total cost of ownership, and what a careful buyer might look for when weighing a plan against the likelihood of future needs. In this sense, the cost structure is both a roadmap and a test: it guides budgeting today while testing whether the protection is worth its cost in the years ahead.

The starting point is clarity about what the contract is designed to cover. A typical vehicle service contract focuses on ongoing maintenance and major repairs after the manufacturer’s original warranty lapses. The premium is not just a fee for the chance of a future repair; it is a premium for peace of mind, the promise that certain parts or systems will be serviced or repaired under agreed conditions. This framing matters because it places price within a broader calculus: the owner is balancing the risk of costly failures against the recurring cost of protection. The math becomes more meaningful when the discussion moves from abstract protection to concrete numbers tied to the specific vehicle and its use. The vehicle’s make, model, and year matter because repair costs vary widely across the spectrum of automotive technology. A newer, simpler engine system may drive a different risk profile than a high-tech, performance-oriented powertrain. Vehicles with historically expensive repairs or parts that wear quickly can pull the premium higher, while simpler, more reliable configurations can restrain it. When combined with the anticipated mileage, these factors sculpt the overall cost in a way that is highly individualized rather than universal.

Mileage, in particular, is a blunt but informative signal. The more miles a vehicle accumulates, the higher the expected wear and the greater the chance that a component will fail as covered by the contract. This can push the price upward or influence the choice of plan level. A contract that looks attractive at low mileage may become mismatched as mileage grows, especially if the plan contains caps or thresholds tied to mileage bands. In other words, the cost structure is dynamic: it shifts with usage patterns. A responsible buyer will therefore consider not only the current miles on the odometer but the anticipated miles for the next several years, along with the expected schedule of road trips, commutes, and long-haul drives. The same logic applies to the contract’s duration. A multi-year term can spread the annual cost more evenly and may unlock lower average rates, but it also locks the owner into a fixed price for a longer period. Conversely, shorter terms offer greater flexibility and potentially lower upfront costs, yet they may fail to protect against a stretch of high expense before renewal. These choices shape both monthly cash flow and the total outlay when the contract expires.

The level of coverage is the next mover in this price equation. Plans commonly fall along a spectrum from more limited, often called powertrain-focused coverage, to broader, comprehensive protection that includes dozens of systems from electronics to steering and suspension. Each tier carries its own blend of protection and price. A broader plan typically features fewer gaps and a lower deductible, but it comes with a higher upfront premium and more potential ways for the contract to be constrained, such as exclusions and mileage caps. A narrow plan, while cheaper, may leave the owner exposed to important repairs that can be financially devastating if they occur outside the covered scope. In addition to the core coverage, many contracts offer add-ons or optional benefits—towing, rental car reimbursement, and trip interruption are common examples. Each add-on adds to the premium, yet for some owners those extras are precisely the protections that reduce the risk of being stranded or faced with alternate transportation costs during an unexpected breakdown. The decision then becomes a balancing act: how much risk is acceptable, and what is the price tag the owner is willing to pay to shrink that risk?

Deductibles and claim handling mechanisms further shape the cost picture. A deductible works like a personal threshold that the owner pays before the contract coverage begins to pay. Higher deductibles reduce the premium and vice versa. The choice of deductible interacts with the expected frequency of repairs and the owner’s liquidity. For some, paying a higher deductible is a reasonable trade-off for a lower monthly or annual payment; for others, a predictable, deductible-free experience is preferable, even if it costs more upfront. In addition to deductibles, the contract’s administrative structure matters. Some plans impose processing fees, service charges for certain visits, or penalties if a vehicle is serviced outside a network or in non-approved facilities. These charges, while sometimes small individually, can accumulate over several service events and shift the perceived value of the contract. The reportable price, therefore, is not only the sticker price but also the net cost after these fees and the potential savings from misspent resources when the plan’s terms hinder timely service.

The payment arrangement is another thread in the fabric of the cost structure. Many providers offer a choice between an upfront lump-sum payment for the entire term and financed options that allow the cost to be paid in installments. Financing the contract can spread the burden but introduces interest and, depending on the lender, may come with additional fees or stricter terms. The math here is straightforward: financing adds cost over time, so the total amount paid to obtain the same coverage becomes higher than the upfront price, even though the monthly payment may be more manageable. Those who opt for monthly payments should examine the effective annual percentage rate and any promotional terms that could change after an introductory period. It is essential to consider how the chosen financing path interacts with other vehicle-related expenses, such as loan payments, insurance, maintenance, and fuel. A comprehensive budgeting view helps prevent the cost structure from slipping into the background until a surprise repair bill arrives.

Another layer of complexity arises from the way a contract calculates total potential expenditure. The total cost over the life of the contract is influenced by the plan’s coverage limits, the number of covered events, and the probability of those events occurring. Because the same vehicle may experience different failure patterns over time, translating a prospective risk into a fixed premium involves actuarial judgment and contractual assumptions. Owners should scrutinize how the plan handles pre-existing conditions, whether retroactive coverage is available, and how the contract handles wear-and-tear items versus major mechanical failures. Some plans exclude known issues that existed before purchase, while others may offer limited remedies for such conditions if properly disclosed during enrollment. Reading these provisions with attention helps ensure that the cost structure aligns with expected maintenance needs and the owner’s risk tolerance.

The practical meaning of these elements becomes clearest when a buyer weighs the contract against expected maintenance costs without protection. The five-year horizon or up to a specified mileage cap, often 100,000 miles, is a common frame within which these estimates play out. If the vehicle’s maintenance history suggests frequent service needs for items that are explicitly covered, a higher upfront premium may be justified by the avoidance of repeated out-of-pocket repairs. Conversely, if a vehicle is known for reliability and low maintenance costs, a leaner plan with a modest premium and higher deductible might offer better value. In this sense, the cost structure is not merely a price table but a framework that helps owners equate the probability and cost of future failures with the protection that a contract promises. It requires a careful projection of usage, potential failures, and the cash flow implications of either maintaining or foregoing the plan.

For readers who want practical guidance on comparing options, a key habit is to translate contract language into numbers you can compare side by side. Ask yourself what you would pay out of pocket in the likely failure scenarios, and then check whether those costs are capped or offset by the plan. Look for the net present value of the premium, the time value of the coverage, and the flexibility the contract offers when plans are renewed or upgraded. A well-structured contract should present these elements in a coherent way, not as a maze of jargon. It should also provide a clear outline of what happens if you cancel or transfer the contract, including any prorated refunds or fees. The nuance here matters because it alters the real cost over the life of the agreement and, by extension, the decision to purchase.

In terms of readable guidance, practical maintenance planning and cost-saving considerations can be found in resources designed for vehicle owners who want to stay ahead of expenses. For practical maintenance schedules and cost-saving insights, the KMZ Vehicle Center blog offers accessible guidance. See the linked resource to connect maintenance decisions with financial planning in a way that complements the hard numbers of the contract. KMZ Vehicle Center blog.

Ultimately, the price of a vehicle service contract reflects a careful trade-off between risk mitigation and cash flow management. It turns a potentially volatile future into a predictable monthly commitment, while also embedding a set of choices about coverage breadth, deductibles, terms, and add-ons. The best approach to understanding the cost structure is to treat it as a comprehensive budgeting exercise rather than a single price tag. When done well, it reveals not only how much protection costs, but how that protection aligns with a vehicle’s actual needs, the owner’s tolerance for risk, and the financial discipline required to maintain reliability over time. For a broader frame on how these plans interact with other vehicle-centered costs, consider consulting external resources that present the broader landscape of extended protection and maintenance planning. External resources such as research and guidance from established technical and consumer sites can provide additional context to ensure that a buyer is comparing like with like and not conflating maintenance schedules with insurance-like protection. See an external reference for further reading here: https://www.autopom.com/.

Guardrails and Guarantees: How Responsibilities Shape a Vehicle Service Contract

A vehicle service contract is more than a simple add-on or a shelf-heavy promise about repairs. It is a carefully structured agreement that translates the idea of ongoing care into concrete terms: what gets covered, for how long, and at what cost. In its essence, a service contract delineates who does what, when it happens, and under what conditions, so that both the vehicle owner and the service provider share a clear understanding of expectations. It sits at the intersection of maintenance planning and risk management, offering a framework that extends the vehicle’s life beyond the factory warranty and into a predictable rhythm of care. The contract is not merely about slapping a price on future fixes; it is about codifying a plan for regular attention and timely interventions, with the aim of preventing cost shocks and preserving performance over time.

At the heart of any vehicle service contract are the provider’s responsibilities. The core obligation is straightforward: cover the cost of repairs for the components and systems that the contract specifies as covered. This typically includes major elements such as the engine, the transmission, and the drivetrain, and it can extend to electrical or electronic components depending on the plan chosen. The precise scope, of course, is defined in the contract terms, which means two things for the buyer: first, that coverage is not universal and may exclude certain systems or failure modes; and second, that the value of the contract hinges on how well the coverage aligns with the vehicle’s actual needs. A thoughtful buyer will compare plans not only by price but by what is actually included, because coverage that seems generous in name may prove less useful in practice if it omits key failure points.

Guarantees offered by a service contract vary with the provider and the level of coverage selected. Basic plans tend to address major mechanical failures, offering protection against sudden, substantial repair costs that could disrupt operation. More comprehensive or premium plans often broaden the safety net to include a wider set of benefits. Those benefits can extend beyond the repair itself to services that reduce the inconvenience of a breakdown: towing, rental car reimbursement, or roadside assistance. The practical effect of these guarantees is to convert a potentially volatile maintenance expense into a more predictable outlay, a shift that can be especially valuable for owners who rely on their vehicle for daily commuting or business needs. When considering guarantees, it helps to look beyond the surface and ask what happens if a covered component fails, how a claim is processed, and what the owner must do to keep coverage in force. A plan might guarantee that repairs will be performed to a certain standard, or that replacements will meet specified quality criteria, or even that compensation will be provided if a covered repair cannot be completed within a defined time frame. The exact articulation of these guarantees—whether it is a repair-and-replace guarantee, a labor warranty, or a broader set of protections—shapes the contract’s practical usefulness as a risk management tool.

Equally important are the exclusions. No contract covers everything, and the list of what is not included often defines the contract’s real-world value. Wear-and-tear items such as brakes or tires, routine maintenance tasks like oil changes, and damage arising from misuse or neglect are common exclusions. These categories remind prospective buyers that a service contract is not a substitute for regular upkeep or prudent vehicle use. Instead, it acts as a backstop for specific, non-wear failures that fall within the plan’s defined scope. Understanding these boundaries is essential because it clarifies where the owner’s responsibilities end and where the provider’s obligations begin. A thoughtful reading of exclusions also guards against expectations that cannot be met, which can otherwise lead to disputes or disappointment when a claim is denied.

From the consumer’s perspective, the decision to enter a service contract comes down to a careful balancing of value, risk, and practicality. It is not enough to be enticed by a low upfront price or by a glossy list of included systems; the real question is whether the contract’s protections align with the vehicle’s usage, the owner’s financial tolerance for uncertainty, and the realities of potential repairs. When evaluating options, readers should scrutinize the terms with the same rigor they apply to any major purchase. This includes comparing providers, assessing claim processing efficiency, and weighing the reliability of the coverage offered. Independent resources often evaluate extended warranty providers on these dimensions, offering guidance on which programs tend to deliver on their promises and which ones fall short in practice. Such diligence helps ensure that the contract chosen offers steadier protection rather than simply a cheaper price tag.

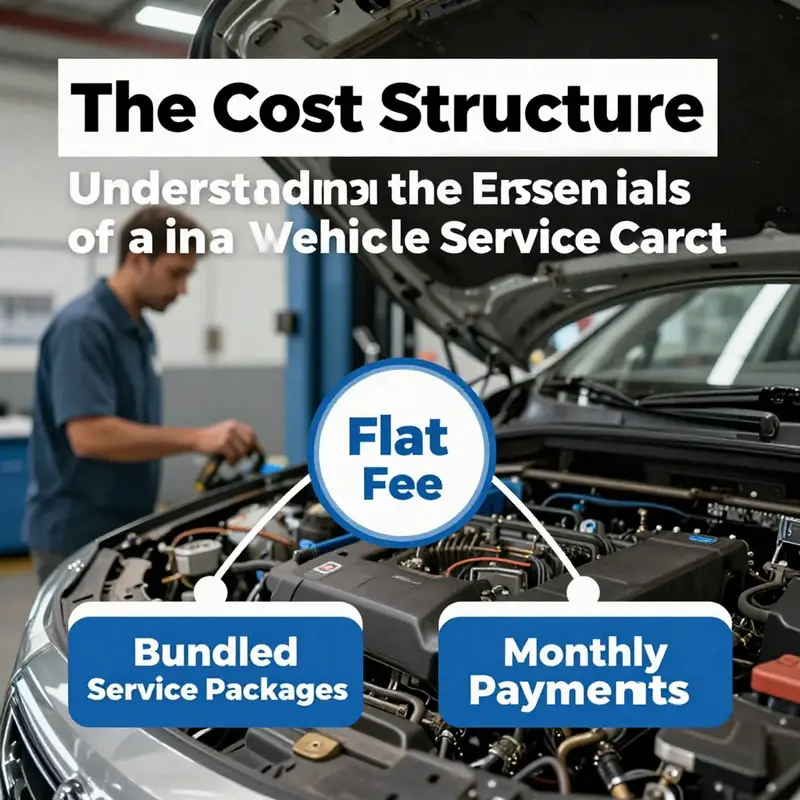

The structure of the contract’s cost is another key consideration. Long-term maintenance and repair plans can be arranged in several ways. Some contracts operate on a flat fee per service, while others use a fixed monthly or annual rate. Still others price coverage per unit of work or service, which can feel more transparent when the maintenance needs of a fleet or a specific vehicle are steady. A common approach is a framework agreement that bundles multiple services at a pre-negotiated rate, providing predictability in budgeting and reducing the administrative burden of paying for each individual repair. For owners who want clarity and consistency, such arrangements can be highly appealing because they convert unpredictable repair bills into a known, manageable cost. Yet the appeal hinges on the contract’s alignments: the rate must be commensurate with the likelihood and cost of covered repairs, and the bundled services should match the vehicle’s actual maintenance requirements rather than offering a one-size-fits-all safety net.

The conversation around responsibilities and guarantees also benefits from a broader view of how service contracts fit into ongoing vehicle care. Regular maintenance is the backbone of any reliable contract, because even the most comprehensive plan can be undermined by neglect or missed service intervals. A well-structured contract envisions a partnership: the owner commits to bringing the vehicle in for scheduled checks and timely maintenance, while the provider commits to delivering the agreed repairs with quality parts and professional workmanship. In practice, this partnership helps keep vehicles healthier, reduces the likelihood of expensive, surprise failures, and preserves resale value by maintaining a documented trail of care. The alignment between maintenance discipline and contract protection is a crucial reason owners pursue these agreements in the first place.

For readers who want practical, hands-on guidance on maintenance, a wide range of resources can illuminate how to keep vehicles in peak condition between major repairs. For example, practical maintenance tips tailored to different vehicle types can be especially valuable for first-time owners seeking to understand the rhythm of care their contract assumes. Truck maintenance tips for first-time owners offers accessible, concrete advice that complements the formal protections described in a service contract. Such guidance helps ensure that owners are not only protected in the event of a covered failure but also proactive in preventing losses through disciplined upkeep. The combination of clear coverage terms and diligent maintenance creates a more resilient ownership experience, one that reduces the friction and anxiety often associated with complex financial protections.

As buyers navigate this landscape, it is helpful to remember that independent evaluations can add clarity to the decision. Resources that assess claim-handling efficiency, customer satisfaction, and overall value provide a counterbalance to marketing claims. These evaluations can help a buyer distinguish between plans that promise broad coverage but deliver little practical assistance and those that truly stand behind their guarantees when a claim is filed. In this light, a service contract emerges not as a vague assurance but as a well-defined instrument with real consequences for how repairs are managed, funded, and completed. The result is a purchase that is less about theater and more about reliable execution when you need it most.

For a broader perspective on how these contracts function in the market, readers may wish to consult external perspectives on extended warranties. Consumer Reports’ comprehensive guide to extended warranties offers a thoughtful examination of when such protections make sense and how to assess their value. While every contract is unique, this kind of independent analysis helps frame expectations and sharpen decision-making. External resources can provide context that supports prudent choice rather than simply inflating the sense of security that a glossy promise might create. For a detailed, independent evaluation of extended warranties, see the guide available at https://www.consumerreports.org/vehicles/extended-warranties-a-2026-guide/.

Final thoughts

A vehicle service contract is more than just a paper agreement—it embodies a commitment to keeping your car in optimal shape while defining the responsibilities and costs involved. Understanding the core services, scope of work, service periods, cost structures, and guarantees is essential for any car owner or small fleet operator. This knowledge not only grants peace of mind but also ensures that you are prepared for any eventuality on the road. Armed with this insight, you can confidently navigate the world of vehicle service contracts, ensuring your investment remains protected and your vehicle operates at peak performance.